It’s important to know your rights and responsibilities as a condominium unit owner or condominium building owner. This knowledge allows you to efficiently file insurance claims and address claim disputes. Understanding the elements covered in condo insurance can also help owners make informed decisions about claims and motivate reimbursements they believe are fair.

This guide explores what condo insurance covers, the rights and responsibilities of condo owners, how to choose a reliable condominium insurance policy, and the steps to take after a condo insurance claim denial.

What Is Condo Unit Insurance?

Condominium unit insurance, also known as condo insurance or homeowner’s insurance, is coverage that pays for damage related to a condo unit. A condo or condominium is a residential or housing complex with separate units owned by individual owners. When a condo is damaged, condominium insurance helps fund the repair of the interior of your unit and personal belongings, depending on the damage the insurance policy covers.

For unit owners, coverage usually extends from the studs inward. Condo insurance typically covers elements the condominium owners association (COA) master policy does not cover, such as flooring, interior walls, and fixtures inside the unit. It also covers personal property and provides liability insurance.

A COA, also called a condo association, is a governing body that includes all condo unit owners within a particular neighborhood, complex, building, or planned development. The association is responsible for maintaining shared spaces and ensuring everyone pays their fees and follows the rules. While a COA may have coverage for shared areas outside individual units, unit owners should get condominium insurance for the interior of their condo for more comprehensive property coverage.

What Can Condo Unit Insurance Cover?

Your condominium insurance policy can have numerous coverages that pay for particular occurrences. However, the insurance will only cover certain scenarios known as named perils. These are situations the insurance company has established as reasonable events for accepting a claim. Please note that every insurance policy is different and unique so you will need to review your insurance policy to identify what specific it covers. Nothing on this page or elsewhere on our website is intended to be an insurance coverage opinion.

For example, your condo insurance may cover fire, smoke, theft, vandalism, burst pipes, lightning, explosives, wind, and hail. While it depends on your insurance provider, they usually do not cover flooding , earthquakes, nuclear hazards, intentional injuries, or wear and tear. You may be able to add endorsements to cover additional perils or to provide all risk coverage. In this case, everything is covered unless it’s specifically excluded.

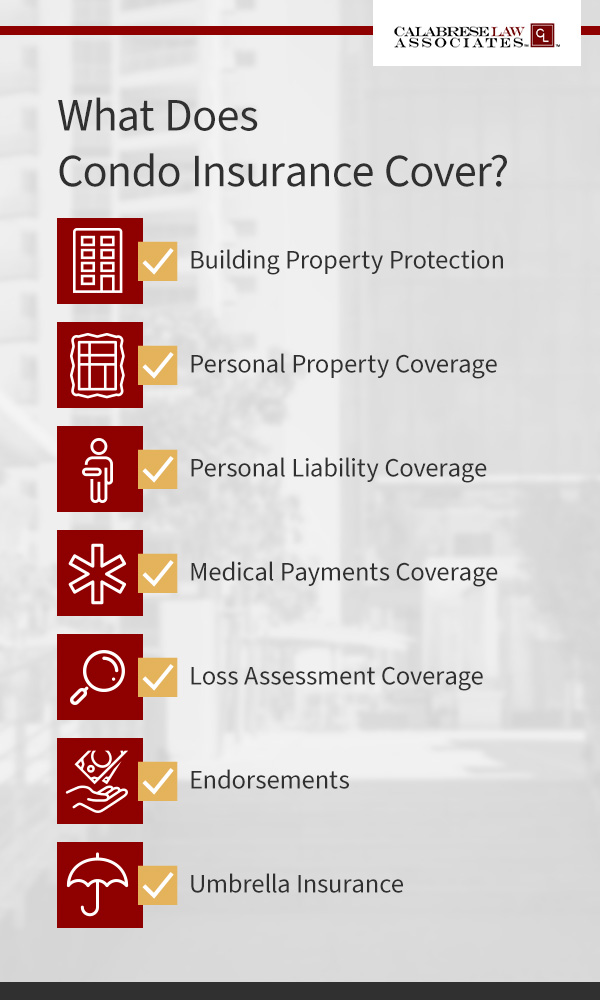

Here are seven elements your condominium insurance policy may cover when incidents are caused by named perils.

1. Building Property Protection

Condo insurance may offer building property protection or dwelling coverage to cover the repairs of your condo’s interior. This coverage may include walls, ceilings, fixtures, and built-in furniture. It’s important to check with your COA about the type of property coverage they have before purchasing this protection. Some coverage types include:

- All-in or all-inclusive coverage:This option pays to fix, improve, or replace items built into the unit, such as appliances, fixtures, and cabinets.

- Bare walls coverage:Bare walls coverage mostly covers repairs to walls, ceilings, and floors, but not the items attached to them.

- Single entity coverage:While similar to all-in coverage in that it fixes and replaces built-in items, single entity coverage does not include improvements and additions to the unit.

2. Personal Property Coverage

Personal property coverage covers the condo owner’s belongings that were damaged within the unit or stolen from it. Belongings that can be covered include furniture, electronics, and clothing — anything from your toothbrush to your artwork. These items will either be repaired or replaced. Unit owners can choose the type of personal property coverage they prefer, with two main types available:

- Replacement cost coverage:Unit owners may be reimbursed for the cost to replace or fix the item, up to the personal property coverage limits. Experts recommend this coverage.

- Actual cash value coverage:This policy type provides a depreciated value for the damaged or stolen item. The compensation you receive may help you purchase a similar item, but you likely won’t be able to buy a new model of the same item.

For example, if you purchased a TV five years ago and a covered peril destroyed it, replacement cost coverage would reimburse the price to get the same type of TV brand-new, while actual cash value coverage would pay the current value of the damaged TV, which probably isn’t much after five years of depreciation.

3. Personal Liability Coverage

Personal liability coverage is valuable when someone is injured or their belongings were damaged on your property, and you are responsible for the property damage or injury. It typically covers legal expenses, such as court and defense costs, and resulting medical bills as part of the legal costs. Personal liability generally covers a person or pet , so it may also apply when a person is injured by you or a pet outside of your condo.

4. Medical Payments Coverage

Your condominium insurance policy may also cover medical payments to other people if they get injured on your property, regardless of whether you were at fault. For example, if a guest trips and falls on your property and fractures a hand, your coverage may pay for the medical expenses of treating their hand.

5. Loss Assessment Coverage

Let’s say your condo association’s insurance policy is not enough to cover damage to the building or property. In this case, each unit owner may need to help pay the rest of the repair and replacement costs. Loss assessment coverage for unit owners exists to help cover these expenses.

For example, this coverage could help pay repair expenses for common areas such as workout rooms or pools. In some cases, it may also cover liability over and above the COA’s coverage limits.

6. Endorsements

What if your coverage is capped at a certain amount? If you believe the amount might not be enough to cover certain repairs and replacement costs, you can consider endorsements or scheduled personal property coverage. This coverage may offer additional funds to fit your needs.

One important endorsement to consider is water sewer backup coverage. This endorsement protects against damage from sewer or drain backups to your unit and other units if you are at fault. For example, if your toilet gets clogged and causes backups in the units connected to yours via sewer, this endorsement would cover all the damage.

7. Umbrella Insurance

A personal umbrella insurance policy is another optional protection that can help you cover large liability claims and judgments. The policy typically only goes into effect when your condominium liability coverage reaches its limit. The policy can also help cover costs when someone sues you for slander or libel.

Every condo owner should have an umbrella policy. You generally need a $300,000 liability limit minimum to qualify for an umbrella policy. The standard umbrella coverage starts at $1 million, but the premiums are typically more inexpensive compared to other policy options.

Common Exclusions in Condo Insurance

There are certain elements that your condominium insurance policy may not cover. Here are three common exclusions you’ll find among insurance companies.

1. Damage Covered by the Condo Association

If your condo owner association’s master insurance policy already covers certain scenarios and elements, it’s likely that your individual condo insurance policy won’t. The master insurance policy covers the exterior of the building and may cover common areas. For example, hail damage to the room would be covered by the master policy.

2. Cyber and Identity Protection

While it can be a valuable add-on to your coverage, cyber protection is not typically included in a standard condo insurance policy. Cyber protection can be helpful when a cyber attack damages the functionality of your digital devices. This coverage helps pay to restore your device’s functionality. It may also cover fees for professional advice on responding to a threat and ID theft monitoring.

3. Flood and Earthquake Coverage

Standard condominium insurance policies typically do not cover water damage caused by floods. Even if you don’t live in an area that’s at high risk for flooding, an unexpected amount of rain can cause a flood-defined claim, so it’s best to purchase a private flood insurance policy. The same goes for earthquakes, which is another natural disaster condo insurance companies may not cover.

What Are the Responsibilities of Condo Building Owners vs. Unit Owners?

Understanding your responsibilities as a condo unit owner or main member of a condominium corporation can help you make informed decisions about insurance claim outcomes and damage claims against you. While condominium unit owners are individuals responsible for the condition of their individual units, the condominium building owner is typically a condominium corporation or the condominium owners association as an entity.

The association sets and upholds the rules and bylaws governing the condo property as a whole. The condominium corporation or association requires unit owners to follow these rules. While a COA consists of individual unit owners, the association as an entity has particular responsibilities:

- Creating reasonable unit restrictions that bind unit owners

- Enforcing condo bylaws and rules equally

- Adhering to the master deed, condominium bylaws, rules, and regulations

- Setting reasonable fees, interest rates, and fines

- Using association fees and funds responsibly

- Giving notice of a foreclosure action to the unit owner before it is initiated

- Making decisions that benefit the whole condo community

- Ensuring appropriate and adequate coverage in the master insurance policy

The condo unit owner also has responsibilities that allow them to make better decisions as an association member:

- Paying their share of condominium expenses

- Complying with condominium bylaws, regulations, administrative rules, and restrictions

- Not making unreasonable decisions that interfere with other unit owners’ happiness and health

- Fulfilling established obligations in the master deed and trust documents

- Paying expenses related to selling their unit

- Maintaining active, adequate insurance

Steps to Take After a Condo Insurance Claim Denial

Sometimes, claim denials can happen when there are errors or misunderstandings about condo unit owner responsibilities. If you believe your claim was denied unjustly, take the following steps:

- Check for claim errors:Your first step should be to find out why the insurance company denied your claim. Was your claim reason clear, concise, and legally valid? Did you file the claim too late? Read the denial letter to understand why your claim was denied. You can also hire your own adjuster to review the damage, policy, and overall handling of the claim. This route could be a good option, especially for a larger claim.

- Speak with the insurance company:Speak with the insurance provider to ask questions and gain a better understanding of why they made this decision. You should also review your insurance policy and the denial letter in detail to ensure their reasons align with your coverage’s terms and conditions. The denial letter should clearly state why the claim was denied. A legal professional may help you understand these terms better.

- File an internal appeal:If you notice discrepancies, consider filing an internal appeal so that your insurance company can examine your case again with more attention to detail. When submitting this claim, resubmit the relevant forms, include specific timelines, and submit other necessary documents that support your appeal. Clearly write out why coverage should apply using language from your policy.

- Consult with a legal professional:Consider other resolution options if your internal appeal was denied. An attorney familiar with your state’s condominium bylaws can help you file an external review, take legal action or file a complaint with your state’s insurance department.

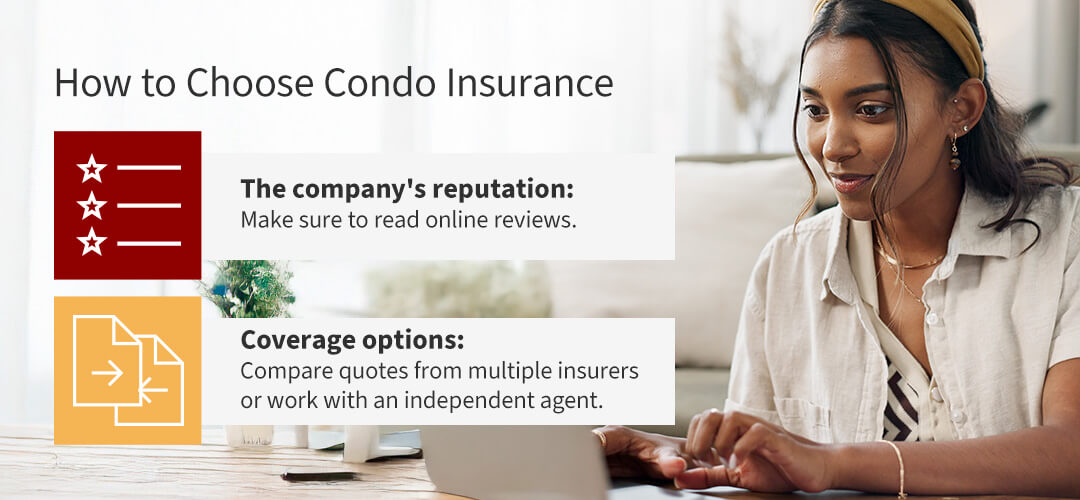

How to Choose Condo Insurance

It’s important to understand what factors to consider when choosing condo insurance as a first-time buyer. Doing so may reduce your chances of working with a provider that may confuse the responsibilities of condo unit owners and condominium corporations. Here are two key factors to consider:

- The company’s reputation:Make sure to read online reviews from past and current customers of the insurance company. Identify patterns like concerns about customer service and claims handling. This will help you choose an insurance company that has fewer of these concerns. You can also check the company’s financial strength rating and verify their licensing on their website, with an insurance regulator, or on a consumer reporting site.

- Coverage options:Compare quotes from multiple insurers or work with an independent agent who can shop around for you and help you choose one that best aligns with your needs. Check all coverage options, what it covers and excludes, and coverage amounts. Comparing deductibles and premiums can also help you choose coverage that is more affordable for you.

Frequently Asked Questions (FAQs) About Massachusetts Condominium Insurance

Do you have particular questions you would like answered? Here are a few commonly asked questions about condominium insurance.

Does Condo Insurance Cover Windows?

Condominium insurance may cover windows as part of building property protection coverage. Keep in mind that the external part of your window may be covered by your COA’s insurance policy , while the interior may be covered by your individual condo insurance policy. You’ll also want to make sure you have coverage for additions or alterations if you replace or upgrade your windows.

Is the Ceiling Part of a Condo Structure for Insurance?

Yes, the ceiling is part of the condominium structure, so insurance policies can cover it as part of building property protection. While this will usually be part of the condo unit owner’s insurance, some condominium associations may take responsibility for individual unit structural elements. Make sure to ask your association about whether they cover unit ceilings.

Does Condo Insurance Include Walls in Coverage?

Condominium insurance typically covers walls as part of the dwelling coverage. While your condominium insurance should cover walls inside your unit, shared walls should be covered by your condo association’s policy. An example of a shared wall includes one that is part of your unit and also a hallway wall.

Why Trust Calabrese Law Associates

Have you experienced issues with your condominium insurance claims or COA disputes? Whether you want to file an internal dispute or take legal action, a condominium law attorney may be able to help you get your concerns across effectively and negotiate your resolution terms.

At Calabrese Law Associates, our attorneys have represented numerous owners of commercial and residential condominium units to resolve disputes. We welcome you to contact us to learn more about how we can help. Here are some of the top benefits of working with Calabrese Law Associates:

- Condominium law knowledge:Our attorneys have comprehensive knowledge of the latest condominium laws and bylaws in Boston, Massachusetts.

- Experienced professionals:We have worked with various condominium owners to help resolve disputes so that repairs or developments can continue in or around their homes.

- Addresses various types of condominium law issues:More than assisting with insurance claim appeals and disputes regarding responsibilities, our attorneys are well-versed in condominium laws to help with issues like restoration issues, COA disputes, construction disputes , and association voting rights disputes.

Receive Help With Condo Law Issues With Calabrese Law Associates

Knowing your responsibilities as a condo owner and what your condo insurance policy covers is the first step to understanding your rights regarding condominium law. If you are having dispute issues, the dedicated attorneys at Calabrese Law Associates may help you find a solution in the Greater Boston Area. For assistance, contact our condominium lawyers today so we can learn more about your situation.

This publication and its contents are not to be construed as legal advice nor a recommendation to you as to how to proceed. Please consult with a local licensed attorney directly before taking any action that could have legal consequences. This publication and its content do not create an attorney-client relationship and are being provided for general informational purposes only.

Attorney Advertising. Prior results do not guarantee a similar outcome.